Progress Report 2025

You can't handle the progress

This is always one of my favourite posts of the year. It’s a chance to look at my financial progress, and hopefully this will inspire others to work on their finances too. The subtitle is a tribute to Rob Reiner (RIP).

You can see last year’s post here (and follow the chain back through time if you are interested -the first was in 2017 or so).

You can also do something similar by doing a quick annual review for yourself. I do this too at the end of the year and go over my personal goals and progress as well as my financial ones.

I track my investments monthly in a spreadsheet and then I copy the December entry onto my annual spreadsheet, which gives me a zoomed out view of progress going back all the way to 2013 when I started doing it. Very much recommended.

I find it useful to go over my accounts and think about them, and hope this will help you see how you can invest over time here in Japan.

We’re going to cover the following areas in order:

Overall Progress

iDeCo Progress

NISA Progress

Mortgage Progress

Pension Progress (new section!)

Giving Progress

Lots to cover, so let’s begin.

Overall Progress

2025 was very mixed for me.

Personally I had a few setbacks and it was one of the roughest years in recent memory. The middle of the year in particular was tough to get through but the last couple of months have been better and I am feeling good about 2026.

Financially we spent a lot more than usual (this was both planned and a good thing) but still ended the year with our net worth in yen terms up 17% compared to twelve months ago. I am expecting some kind of stock market dip or crash sometime soon, but I am not particularly worried about it.

iDeCo Progress

I write this every year. I think iDeCo is one of the best investment options for people who are planning to retire in Japan.

As a kokumin nenkin payer, my contribution limit is currently 68,000 a month (but will go up to 75,000 yen a month from January 2027). I also pay fuka nenkin (400 yen a month) which reduces my iDeCo allowance by 1,000 yen but I think is worth it.

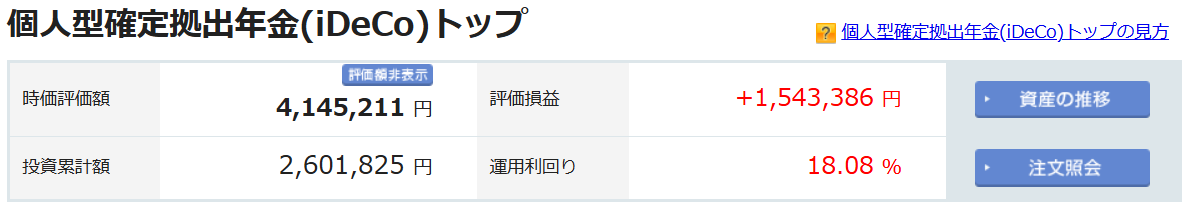

The difference between last year:

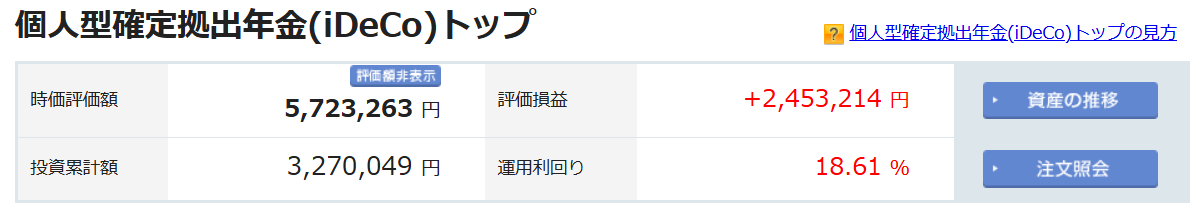

and this year:

is pretty encouraging.

At this rate I’ll be able to pay in for at least another 17 years (it is now possible to pay in until the age of 65), or longer if they extend the limits more in the future.

If I continue paying into iDeCo at this rate I should end up with over 40 million yen in the account by age 65. I would then have the option at that point to leave the funds in there to continue compounding until age 75 at the latest, or just take them out and spend them. Either way, this would probably be more than enough to fund our retirement on its own.

Just shows how effective it can be to invest reasonable sums of money over time.

I have my account with Rakuten and am investing in the Tawara no-load developed country fund.

The reason I chose this fund was fees. The Tawara fund’s annual fee is 0.0989%.

You could also use the Rakuten Plus All-Country Stock Index Fund. This has an annual fee of 0.0561% although it seems the fund has higher actual costs. I will be sticking to Tawara for now.

One great thing about iDeCo is that there are no fees or penalties for switching between funds, so you can rebalance or reallocate within the account whenever you like.

NISA Progress

Well, I managed to fill my NISA account this year, but only by selling investments from my taxable account and buying new ones in NISA.

Here’s how my NISA account is looking right now.

That 10.1 million yen is getting a bit of a boost from my legacy tsumitate NISA holdings (just one year of contributions -400,000 yen-, but it has grown to 711,727 yen already). This will be tax free for another 17 years so I will just leave it alone until then.

I just have one fund in both sections of my NISA account, the eMaxis Slim All-Country fund. I plan to keep buying this until my NISA is full, which should happen by the end of 2028 unless the government changes the rules again (hoping for them to eliminate or increase the lifetime contribution cap, but I don’t think that is very likely to happen).

My wife will also fill her NISA account, which should give us a nice amount of tax free money to spend in retirement.

Junior NISA

Three of my grandkids have Junior NISA accounts. We are no longer able to add money to them, but their investments have continued growing this year and will remain tax free until they are 18, at which point I will try to convince them to open NISA accounts and put all the money in there.

A maxed out NISA (18m yen in contributions) by age 23 should grow to well over 400 million yen by the time they are 60 without them needing to save or add any more money.

This just brings home the power of getting young people to start investing as soon as possible.

If the proposed kodomo NISA accounts are approved by the government, we will likely put some money into our grandkids’ accounts. We have four in Japan now, so we probably won’t be maxing them all out, but even putting a small amount of money in should result in quite a nice sum if it grows over decades.

Mortgage Progress

I still don’t see any reason to pay my mortgage off early. The interest rate on the loan has gone up to 0.9% (floating), but my monthly payment is still under 30,000 yen, and we have 6,430,116 left to pay over the next 20-odd years.

If I get cancer or die the loan will be paid off by insurance, and I am pretty sure investing any spare money will give me a better return than using it to pay down the mortgage.

Pension Progress

Continuing with this section this year given how important pensions are going to be for most people in retirement. Your government pension(s) can provide you with a guaranteed income floor. It is vital that you have a good idea of how much you are likely to receive and that you pay into and claim any pensions you are eligible for.

Being aware of roughly how much pension income you will receive means that you can then figure out how much you need to save and invest in order to pay for the kind of lifestyle you want.

For me, I should receive two government pensions, nenkin from Japan and the UK state pension.

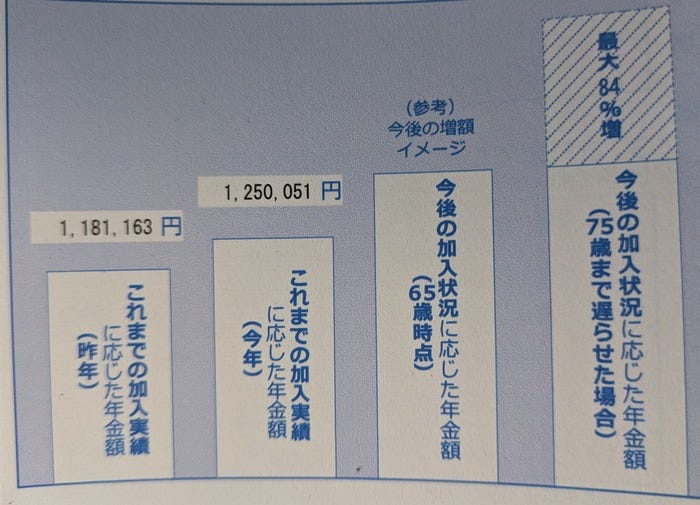

I have paid over 320 months into nenkin since I got to Japan in summer 2000. That would currently get me an annual pension of around 1.25 million yen. I will continue paying kokumin nenkin until at least age 60, but more likely 65. Paying the extra five years on a voluntary basis might be worth it if I can continue paying into iDeCo.

Nenkin will not be anywhere near enough for me to live on, but I guess it might cover food and utilities in retirement.

I have also been making voluntary Class 3 payments into the UK state pension (the more expensive ones). If I had been working in the UK before moving to Japan I may have qualified for the cheaper Class 2 payments, but even Class 3 are a good deal).

Be sure to check out our video about the changes to voluntary contributions from abroad that will start next year if you haven’t seen it yet.

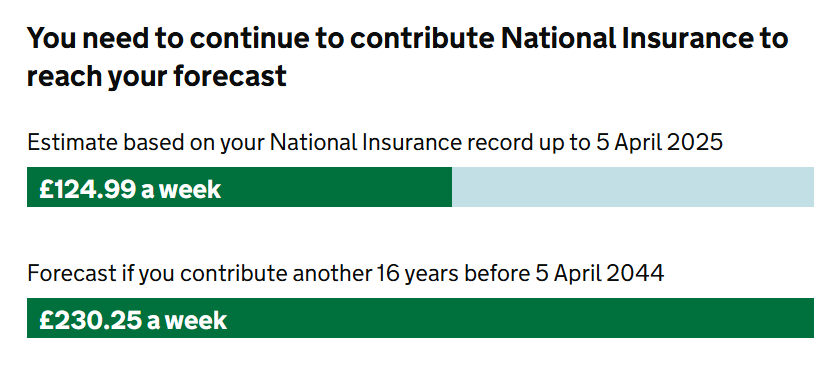

Logging into the Government Gateway site, I get the following projections.

I am still waiting for HMRC to credit my account with the three years I back paid in late 2024, but assuming they do so eventually that just leaves me another 13 years to pay to get a full pension.

If I stopped paying now I would get just over 1.3 million yen a year from my UK pension, and the full pension would be worth almost 2.5 million yen.

Combined with nenkin, I guess I might receive around 4m yen from my government pensions in retirement, which would likely be enough to live on. My wife will also receive nenkin, probably around a million yen a year.

Spending 5 million yen a year might give us a lifestyle similar to the one we have now. Spending 7-8 million yen a year would allow us to do more travel and activities, and I can’t really imagine us wanting to spend more than 10 million a year unless we have runaway inflation or something. Right now our savings and investments would likely cover even that upper number comfortably.

I really recommend looking into your own numbers to avoid unpleasant surprises later on (when it is difficult to do anything about it!).

Giving Progress

I haven’t given much thought to my giving this year, but continue to donate money to the following charities automatically each month:

charity: water $40/month

Courageous Kitchen $25/month

Amnesty International 2.50GBP/month

The Severn Hospice 10GBP/month

Ocean Cleanup $10/month

If anyone would like to donate to charity: water please consider doing so through my referral link.

Donations to Japanese charities can be tax deductible (they use the same tax allowance as furusato nozei) so I prefer to do a single annual donation as this makes my tax return less annoying. The first year I donated to Second Harvest I set up a monthly donation, but then had to input all twelve into my tax return. I have since learned my lesson.

Second Harvest 40,000 yen/year

The Japanese Red Cross 24,000 yen/year

Overall

Well, that was a long post. Thank you for reading all the way to the end!

Things continue to go surprisingly well on the financial front. I can’t believe the numbers looking back to 2008 when I was newly unemployed with no savings, no investments, and no idea of how I was going to pay the bills for my family.

If your finances are not where they need to be, taking action now is the best thing you can do. Let’s make 2025 the year that changes your life trajectory. If you’re unsure of anything check out the info on the site, the YouTube channel, ask a question in the forum or maybe book a coaching call or join our annual course in February.

How are you getting on with your plan? How did 2025 treat you? We’ll be doing a planning post in January, so have a think about your goals before then.

If you enjoyed today’s post and want to contribute to our costs, you could buy me a coffee (more like some web hosting, amirite?) or become a paid subscriber on Substack. All donations much appreciated.

The Monday Read, going out to around 3,000 subscribers each week. Please share this post/email with friends/colleagues who may be interested in it.

Check out the RetireJapan website for more information, the Forum for discussions about personal finance and investing in Japan, and our coaching page if you need more help.

You mentioned that HMRC had not credited some payments you made in 2024. I made a payment by cheque last month when in the UK and it has been credited. Even when I have sent a cheque from Japan, it has not taken more than a month or so to see the credit.